20.01.2016

20.01.2016ECONOMIC CRISIS AND KONDRATIEV THEORY

Ishkhan Sokhakyan

PhD in Economics

1. What is the economic crisis?

From the point of view of economists, the crisis in the global market economy (namely that type of economy) is a quite objective and even predictable phenomenon. This is due to economic cycles, including economic crises. What is the reason for this?

The economic cycle is a periodic fluctuation of business activity level, represented by the real Gross Domestic Product (GDP). GDP encompasses everything produced in a country, including goods, services, etc.

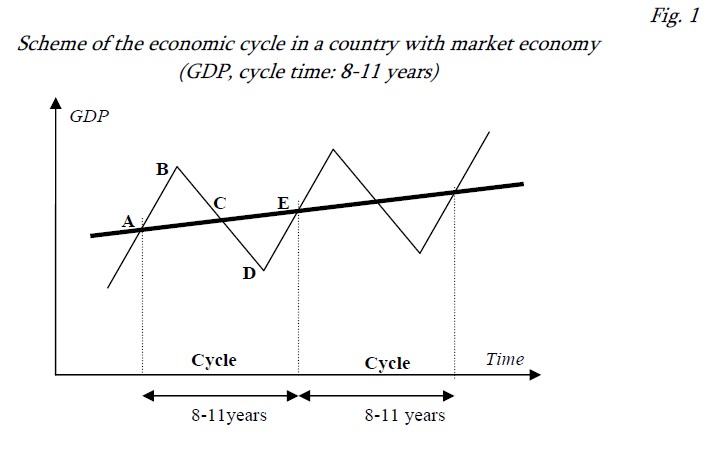

It is obvious, that GDP is constantly growing (see bold line in Fig. 1), but its rate fluctuates. That is why we see from time to time either economic growth (ascending lines in the graph in Fig. 1) or recession (descending lines in the graph in Fig. 1)1.

Different economists define different duration of economic cycles, which is due to their various interpretations of the reasons for recurrence of some of the macroeconomic situations.

What are the reasons for cyclic recurrence? Here we find various preconditions. The most known one consists in consumption patterns that are the fundamental principle of the modern market economy. What is the current economic model? The entrepreneur wants to produce goods and earn money. He or she raises a credit in a bank (the second fundamental principle of modern market economy) and invests it in the production. The company manufactures a product, and the consumer buys it. The earned money is received by entrepreneur, bank, company employees (for consumption and savings), and is also invested in the production of a new item, etc. The basis of all the economy consists in the need (someone's unfulfilled vital desire), which creates the demand (economically active desire), which, in its turn, gives rise to the supply (option to meet the demand). Paraphrasing a classical writer, we can say, "We consume therefore we exist". This is the main point, the essence and the fundamental principle not only of the economic development of all countries and nations, but certainly also of economic downturns, crises and depressions.

The point is that sooner or later the consumption growth is impeded, then stalls or can turn into overproduction crisis.

Certainly, the crisis is not perpetual, sooner or later it will give way to the economic growth. In Fig. 1 the segment AB represents economic growth, the segment BC - recession or crisis, the segment CD - depression or deepening of economic crisis, the segment DE - recovery, rehabilitation, or beginning of a new economic growth.

As we can see in the figure, the duration of business cycles is 8-11 years. These are so-called mid-cycles (caused by technical and technological upgrades), as well as short-term (related to the peculiarities of economic conditions), and long-term cycles (e.g. Kondratiev’s cycles, associated with the change of technological structures).

There is a question, why economic crises became a reality just the last 200 years, and why crises are financial by nature?

We will take an indirect approach in answering this question. All objective processes in the world around us have fluctuating (or wave-form) nature, and the social life is not an exception. J.B.Clark, the patriarch of American economic thought, described the cyclic recurrence quite figuratively: "In the modern world, economic cycles are considered in the same way as ancient Egyptians considered flooding of the Nile. This phenomenon appears from time to time and is essential for everyone, but its real reasons are hidden". A well-known Russian economist Mikhail Tugan-Baranovsky in his book "Principles of Political Economy", wrote about the laws governing the functioning of the market: "The most mysterious and destructive feature of capitalist development is its recurrence. The growth of capitalist production does not follow a straight line but a wavy one, and successive rises and falls of the waves occur with such regularity that resembles the phenomenon of not a social, but biological and even inorganic order. There were even attempts to bring this periodicity into connection with the periodicity of astronomical phenomena".

Obviously, due to the growing influence of nation-states, international institutions, as well as wide range of non-economic (political, military, technological, environmental and other) factors, and scientific and technological progress the “correctness” of cycles’ course was disturbed. However, we cannot deny the objective character of their existence.

We will assume that the cycles appeared with the advent of mankind and always existed since then. However, at the beginning of the 19th century, just after the end of the Napoleonic wars, the world changed fundamentally. It became capitalist in the sense that capital, money and finance defeated military power and became a major factor of power. Before the Napoleonic Wars, the one with the strongest army was the most powerful. Wars were a source of enrichment – the winner plundered the defeated. The defeat of Napoleon - the most outstanding general of the time, who had the strongest army in the world - demonstrated a simple truth: the richest one, rather than the one with best soldiers has the most power. The war between France and England’s manufacturers ended with the absolute victory of capitalists. Since then, and to date the world has had a financial nature, and therefore – the ups and downs of the financial world influence us. Even wars are no more a source of enrichment; they have become an instrument of competition for access to markets, resources, infrastructure, etc.

Since then, finances concern everything; they underlie all phenomena and events of our life, and this is the objective reality. Soviet strategists did not take into consideration the priority of financial issues and got the Soviet Union involved in the arms race. The country with the largest and, without exaggeration, the most powerful army, was completely defeated by the West because of economic backwardness and the failure to ensure an equal financial power.

It came, particularly for historical reasons, that actually money is the main source of everything, and its deficit means the collapse of the world economy.

2. Were there economic crises before?

We can refer the starting point of cyclic development of the market economy to the 1825, when England encountered the first crisis of overproduction. This initiated periodic fluctuations of economy, repeating quite regularly during the 19th century, with an average interval of 8-11 years. With the development of capitalism, other capitalist countries gradually got involved into cycling course. In 1836, the crisis hit both England and the USA. The crisis of 1847 raged already in the United States, Britain, France and Germany, and the next crisis of 1858 was, in fact, the first global cyclical crisis2. The great global economic crisis of 1873-1878 became the deepest and the longest one in the 19th century.

In the twentieth century the global crisis of 1929-1933 (the so-called "Great Depression") broke all records for economic recession. During this crisis the total volume of industrial production in capitalist countries decreased by 46%, the foreign trade turnover - by 67%, the unemployment reached the level of 26 million people (almost a quarter of all people employed in the sphere of material production) and real incomes declined by 58% on the average.

It was during the "Great Depression", when the state took the charge over the situation in the financial market and created conditions for the economic recovery for the first time. The basic anti-crisis plan, proposed by President Roosevelt ("New Deal"), included the following steps:

- Establishment of state control over the financial system to channel financial resources to the development of the economy,

- Creation of new jobs, including those, created with the help of the Institute of Public Works,

- Stimulating domestic demand and private investments of citizens.

All these steps provide an effective demand and economic growth.

These measures were theoretically substantiated by the famous American economist John Maynard Keynes in his "General Theory of Employment, Interest and Money." The basis of the Keynesianism consists in the concept of state regulation of the economy, which significantly increases the role of public institutions in investment promotion and effective demand.

It is obvious, that all of the mentioned measures from "New Deal" of Roosevelt and Keynes's concepts are still relevant nowadays and are used in modern Russia.

After the Second World War financial crises occurred, for example, in 1957-58, 1973-75, 1980-82 etc.

The global financial crisis of 1997-98 that affected Asia ("the Asian financial crisis"), Latin America and Eastern Europe, including Russia, was one of the recent ones. Among developed countries, Japan that is closely linked with its Asian neighbors was hurt most severely. At the same time leading European economies and North America have been affected by the crisis to a much less extent. The current financial crisis is the first in the new millennium. The world economy has not known such large-scale disturbances in the new century yet.

Furthermore, financial crises have been global never before. Even the Great Depression did not touch directly, for example, the current BRICS countries that constitute almost a half of the global economy. The current crisis is unique, because it is really global. It means that it concerns all regions, countries, sectors, enterprises and world economies.

3. What are Kondratiev waves/cycles?

Nikolai Dmitriyevich Kondratiev (in some sources also referred to as Kondratieff, March 4, 1892 –September 17, 1938) was a Russian economist, who was a proponent of the New Economic Policy (NEP), which promoted small private, free market enterprises in the Soviet Union. He is best known for proposing the theory that Western capitalist economies have long term (50 to 60 years) cycles of boom followed by depression. These business cycles are now called "Kondratiev waves".

Nikolai Dimitrievich Kondratiev was born on March 4,1892 in the province of Kostroma, north of Moscow, to a peasant family of Komi ethnic heritage. He was tutored at the University of St. Petersburg before the 1917 Russian Revolution by Mikhail Tugan-Baranovsky. A member of the Socialist-Revolutionary Party, his initial professional work was in the area of agricultural economics and statistics and the problem of food supplies. On 5 October 1917, at the age of 25, he was appointed Deputy Minister of Supply of the last Alexander Kerensky government, which lasted for only a few days.

After the revolution, Kondratiev pursued academic research. In 1919, he was assigned to a teaching post at the Agricultural Academy of Peter the Great. In October 1920 he founded the Institute of Conjuncture, in Moscow. As its first director, he developed it into a large and respected institution with 51 researchers by 1923.

In 1922 he published his first writing on long cycles., The World Economy and its Conjunctures During and After the War. His writing that capitalist economies were characterized by successions of expansion and decline contradicted the Marxist idea of the imminent collapse of capitalism. In 1923, Kondratiev intervened in the debate about the "Scissors Crisis", following the general opinion of his colleagues. In 1923–25, he worked on a five-year plan for the development of Soviet agriculture. In 1924, after publishing his first book, presenting the first tentative version of his theory of major cycles, Kondratiev traveled to England, Germany, Canada and the United States, and visited several universities before returning to Russia. In 1925 he published his book The Major Economic Cycles which quickly was translated into German. A short form was published in 1935 in the Review of Economic Statistics and for a time his ideas became popular in the West, until eclipsed by those of John Maynard Keynes.

Kondratiev's economic cycle theory held that there were long cycles of about fifty years. In the beginning of the cycle economies produce high cost capital goods and infrastructure investments creating new employment and income and a demand for consumer goods. However, after a few decades the expected return on investment falls below the interest rate and people refuse to invest, even as overcapacity in capital goods gives rise to massive layoffs, reducing the demand for consumer goods. Unemployment and a long economic crisis ensue as economies contract. People and companies save their resources until confidence begins to return and there is an upswing into a new capital formation period, usually characterized by large scale investment in new technologies.

A member of the People's Commissariat of Agriculture and a proponent of the Soviet New Economic Policy (NEP) supported by Vladimir Lenin, Kondratiev was influential with writings about agriculture and planning methodology. Influenced by his trips overseas, he advocated a market-led industrialization strategy emphasizing export of agricultural produce to pay for industrialization, following the Ricardian economics theory of comparative advantage. He proposed a plan for agriculture and forestry from 1924 to 1928. However, after the death of Lenin in 1924, Joseph Stalin, who favored complete government control of the economy, took control of the Communist Party. Kondratiev's influence quickly waned.

According to the late Harvard sociologist Carle C. Zimmerman, Kondratiev was reported to Soviet authorities by a member of the University of Minnesota agriculture faculty in 1927 after a visit to sociologist Pitirim Sorokin, a fellow Komi: “Kondratieff (sic), an agricultural economist and student of business cycles, visited Minnesota in 1927 and stayed with Sorokin. A number of prominent American scientists were pro-communist at the time. One was a forester at the Ag campus where I had an office. He upbraided me for associating with Sorokin and Kondratieff and told me he was going to send a report about Kondratieff back to Russia. Later I learned that Kondratieff was arrested immediately after returning to Russia from the trip to see American universities. However, he was not given the final "treatment" until the Stalinist purges of 1931.”

Kondratiev was removed from the directorship of the Institute of Conjuncture in 1928 and arrested in July 1930, accused of being a member of a "Peasants Labour Party" (allegedly a non-existent party invented by the NKVD). Convicted as a "kulak-professor" and sentenced to 8 years in prison, Kondratiev served his sentence, from February 1932 onwards, at Suzdal, near Moscow. Although his health deteriorated under poor conditions, Kondratiev continued his research and decided to prepare five new books, as he mentioned in a letter to his wife. Some of these texts were indeed completed and were published.

His last letter was sent to his daughter, Elena Kondratieva, on 31 August 1938. In September 1938 during Stalin's Great Purge, he was subjected to a second trial, condemned to ten years without the right to correspond with the outside world. However, Kondratiev was executed by a firing squad on the same day the sentence was issued. Kondratiev was 46 at the time of his execution.

In the 1970s increased interest in business cycles led to the rediscovery of Kondratiev's work, including the first-time publication of a complete English translation of his seminal article "The Long Waves in Economic Life" in the journal Review (Fernand Braudel Center) in 1979 (the article was originally published in a German journal in 1926 and a partial English translation appeared in the journal The Review of Economic Statistics in 1935). This rediscovery of Kondratiev in English-speaking academia led to his theories being extended for the first time beyond economics as, for example, political scientists such as Joshua Goldstein and geographers such as Brian Berry extended the concept of Kondratiev long waves into their own fields. However, Kondratiev's theory remains controversial because, among other issues, of his ideas about the periodical character of the replacement of basic capital goods and the empirical possibility of coincidence in identifying long waves (i.e. that long waves are simply an epiphenomenon).

In 1987 the Soviet Union officially rehabilitated Kondratiev. His select works were first translated into English by Stephen S. Wilson in 1998. In 1992, to commemorate the centenary of his birth, the International N. D. Kondratiev Foundation was established in Russia.

By 1926, the great economist Nikolai Kondratiev completed the establishment of the theory of large cycles in the economy. Kondratiev’s research covered the 150-years development of the leading capitalist countries - the U.S., Germany, England and France. Using the methods of mathematical statistics, Kondratiev analyzed a wide range of indicators of economic development in these countries: price indices, government debt securities, nominal wages, foreign trade, coal, gold, iron, lead production etc. Based on the statistical data, Kondratiev hypothesized the existence of the long cycles of economic situation lasting 48-55 years, along with the usual 8-11-year cycles.

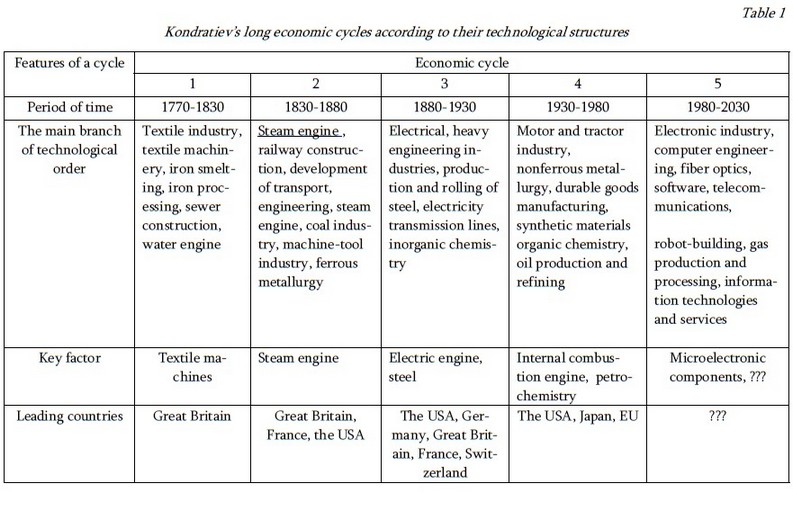

The turnover of long cycles is due to changing technological structures, that is, depends on the way of main products and services production in the economy. Thus, Kondratiev and his followers marked out five principle cycles in the economy (see Table 1).3 Formally, we currently deal with the beginning of the fifth "information and communication" technological system and the fifth economic cycle for the last 200 years. But, it is obvious that the Kondratiev’s technical and economic cycles overlap each other, and we can talk only about the dominance of a particular way of life in the presence of elements of the previous and the next one.

Actually scientists are inclined to the view that the world economy is now "influenced by the end" of the previous, fourth techno-economic cycle, characterized by mass production and consumption of durable goods, including automobiles, household appliances and electronics. Another factor that indicates this influence of the fourth cycle, is an "insatiable" energy consumption observed in the developed world in recent years, which led to an unprecedented increase in oil prices in the spring and summer of 2008, when the price for a Brent barrel almost reached the level of U.S. $ 150.

4. What was the starting point of the current global financial crisis?

We started to talk about the crisis in 2006, immediately after the appearance of signs of the U.S. mortgage crisis.

What is the root cause of what happened? It is very important for almost eaevery American to have his or her own house. Not apartment and cottage, which is typical for us, but a house (two - or three-storey one) with a small plot of land.

U.S. banks (all largest ones) provided mortgage loans for everyone with minimal provision for the construction or purchase of new or already constructed houses. Under these loans new loans were given and so on - a huge pyramid like Russian MMM built at the time. Now imagine that the house, which was bought for the very first loan, was not built, or dropped in value, or its owner cannot repay the loan anymore for some reason. As a result this entire pyramid had to collapse sooner or later. A multibillion bubble bursts at once. And this credit game involved almost all the financial systems of the world that were confident in the high efficiency of the U.S. economy. Today, many of them, for example the one of Iceland (this small country is on the verge of bankruptcy), are in an extremely uncomfortable situation.

The mortgage crisis, as it is known, was just the beginning of the financial crisis. Multibillion-dollar losses of financial institutions involved in the mortgage market, led to the withdrawal of financial resources from other industries and markets, prompting the so-called chain reaction, when one crisis creates another.

Investments from all over the world were made in equity of these financial institutions, and therefore the mortgage crisis became a financial one and spread to other countries and continents.

5. How long will the crisis last?

According to the past experience the recession is unlikely to last for more than three years, however the world has seen longer lasting crises.

The longest test in the history of the capitalist economy was the crisis of 1873-1878 that spread over almost all continents. The precondition for this crisis was the credit rise in Latin America, nourished by England and the speculative boom in real estate in Germany and Austria. The Great Depression began on October 24 1929 (the Black Thursday) and was largely overcome only in 1933, although the effects of the crisis could be felt up to late 1930s. The Asian-Russian crisis of 1997-1998 lasted almost two years. The modern global financial crisis lasted already five years, considering that it began in 2008.

What can we expect from the modern economy in near future?

There are several points of view on this issue. Some economists think that the world economy has reached the very bottom and the decrease in energy prices will cause a decrease in costs and create conditions for new economic growth. This point of view has the right to exist, but it should be considered that global economy is developing irregularly.

If the mortgage crisis that broke out in the USA at the turn of 2006-2007 is more or less coming to an end, the recession in Europe and Japan is only starting to gain momentum, and some large Asian and Latin-American economies are barely approaching the downturn. Considering the world economy is a single, yet managed from different centers, system, the improvement of the world economy is only to come after the majority of national economies make it through the crisis - which is certainly not going to happen in the short-term.

Other economists think that the crisis is "here to stay" as the modern economic model based on egoism and parasitism has become obsolete. It is impossible to develop further if some countries of the world "create nothing on their own" and live at other countries' expense. Indeed, the US economy, recently so oversaturated with money, has found itself in the liquidity deficit conditions. All these hundreds of billions of dollars, not so long ago circulating in the fund, mortgage, currency etc. markets of the USA - where have they all gone? Perhaps, there were no billions of dollars in the first place? Perhaps, that was, so to say, "unreal", "virtual" money, that was not earned (or not "labor money", according to Marx)? Perhaps it is necessary to find other ways of enrichment, that hadn't been used before.

Thus, before the election for the second presidential term the American President Barack Obama asked voters for the extra time to steer the economy through the crisis.

As for Russia, the country along with all the major emerging markets is only entering a phase of the economic downturn and, officially, the recession have recently occurred: the decline in production is not yet catastrophic, the inflation is within certain limits, the state budget still has enough of money.

There is much talk about the second and subsequent waves of the global crisis. They are already becoming real. While the first wave, one way or another, has been associated with the U.S. mortgage lending crisis, it is obvious that the second one is primarily based on the sovereign debt of the EU members, in particular, its "southern belt" - Greece, Spain and Italy. At the same time, the large-scale financial crisis in Asia and Latin America is probably still to come.

6. What were the symptoms of the crisis? When did they start to appear?

The first symptoms of the financial crisis became apparent in 2006 with the advent of first crisis phenomena in the American economy related to mortgage lending.

Almost all the companies providing home loans in the U.S. with low lending standards reported losses. A number of second-tier mortgage operators announced their withdrawal from the market, and in some cases, bankruptcy.

Back then, few could have predicted that this would be the beginning of a global recession, and difficulties with the repayment of mortgage loans in the U.S. would lead to a global economic fall.

In 2007, the mortgage crisis unexpectedly spread around. The crisis in the U.S. mortgage market went to Europe. The world system began to suffer from liquidity shortage.

The main symptom of the crisis became obvious, and after this, it became clear that the coming recession would be very serious. The question is about the mass exodus of investors from the stock market and their flow to other sectors, such as commodity markets.

The world economy felt such evasion first-hand, when vast resources of the speculative capital came to the oil market. Within the period between early 2007 and mid-2008, the price for this energy source went up by almost $90 (approximately from 60 to 150) per barrel.

In Russia, this has resulted in the flow of financial resources to the real estate market, especially in housing, which led to the rapid growth in housing prices in Russian cities.

In general, the main sign of any crisis consists in an "abnormal", massive capital outflow from one sector (e.g., financial) to another (such as commodity), or vice versa. There is nothing unusual in the capital flow; this is a normal phenomenon in the modern economy. What is abnormal is the excessive concentration of the capital in any one industry.

Economic equilibrium implies that at the same time the profitability of various business activities is practically equal to the fluctuations within a few percent (the economic variant of communicating vessels). Investments in real estate, mutual funds, deposits, securities, etc. should be about the same. The situation where investments in real estate or in oil speculations are several times more profitable than deposits or mutual funds, of course, is not normal, and sooner or later, leads to the crisis in the economy. This situation reminds of the ship, where all the passengers with the luggage accumulated on the deck near one of the broadsides, which inevitably complicated the further movement of the ship and could even lead to a shipwreck.

7. Is the current crisis similar to the crisis phenomena in the global and Russian economy in 1997-98?

It has already been mentioned that the crisis of 1997-98 was not global, so it is, partly, not like the current one.

However, the Russian-Asian crisis is interesting for us because Russia and most of its citizens were directly involved in it.

What were the main characteristics of the crisis?

The Asian crisis was a consequence of the foreign investors’ departure from South-East Asia due to the devaluation of national currencies in the region, and high external deficit of the countries in the region.

It is assumed that the crisis in Russia was caused dy the following factors:

- a huge state, first of all, foreign debt of Russia,

- low oil prices, on which Russia has traditionally depended,

- pyramid of short-dated bonds, for which the Russian government has failed to repay in time.

As a result, in August 17, 1998, the government of Sergei Kiriyenko announced "technical default" of $40 billion thus recognizing Russia’s and its banks’ failure to pay its credit obligations and that led to the collapse of many financial institutions that invested in short-term bonds, the ruin of many businesses and loss of ordinary citizens’ deposits in many Russian banks. Rate of the ruble against the dollar in August 1998 - January 1999 fell by more than 3 times - from 6 rubles to 21 rubles per US dollar. The prices for goods and services also rose more than threefold in average.

Certainly, now the situation is somewhat different: Russia does not have "catastrophic" internal and external debts. Moreover, there are significant gold and foreign exchange reserves and the Reserve Fund, and oil prices did not fall to the level of, say, $10 or 30 per barrel. It can be argued that Russia was prepared to the crisis thanks to its capacities.

However in 1997-1998 the most part of the world economy was not in a crisis and, in this regard, the country could count on foreign support - through foreign loans and investments. It is not by chance that 2000 became a record year for the last 20 years in terms of the volume of attracted investments into the real sector of the Russian economy, which allowed Russia to gain a strong economic growth observed in the last 10 years. Now Russia should to a lesser degree rely on the help of foreign countries, international institutions and foreign investors due to the fact that now the whole world economy is experiencing an extreme shortage of liquidity and is in a great need of investments.

Another distinctive feature of this crisis is the fact that its causes lay outside Russia. The crisis events in Russia are consequence, and therefore let us hope that the depth of the economic recession in Russia will be less catastrophic.

1 Novichkov N.V. World financial crisis: between the past and the future // Modern Europe. - М.: Europe Institute RAS. 2009, №3.

2 Novichkov N.V. World financial crisis: between the past and the future // Modern Europe. - М.: Europe Institute RAS. 2009, №3.

3 Glaziev S.Y. Theory of the long-term technical and economic development. – M., P.96-99

References and Literature

1. Глазьев С.Ю. Теория долгосрочного технико-экономического развития. – М., 1993.

2. Кондратьев Н.Д. Проблемы экономической динамики. – М., 1989.

3. Новичков Н.В. Мировой финансовый кризис: между прошлым и будущим // Современная Европа. - М.: Институт Европы РАН. 2009, №3.

4. Липина С.А. Россия. Итоги первого десятилетия реформ. LAP LAMBERT Academic Publishing GmbH and Co. KG, Saarbrucken, Germany, 2011г.

5. Липина С.А. Социо-экономика России переходного периода. 1991-2003. Москва, УРСС, 2004г.

6. Политическая экономия и история экономических учений: Учебник. – М., 2004.

7. http://www.gks.ru/wps/wcm/connect/rosstat/rosstatsite/main/trade/#

Return